Introduction to the Presale Trap

Presales in the cryptocurrency market have become an enticing opportunity for many investors seeking to capitalize on the significant returns that new projects often promise. These events allow early adopters to acquire tokens at a lower price before they are publicly available, creating the potential for substantial rewards if the project is successful. The excitement surrounding presales is palpable, as investors eagerly anticipate the next big breakthrough in technology or finance that could emerge from these initiatives. Moreover, the rapid development cycles and innovative solutions presented by emerging projects often capture public interest, leading to a rush of investment as individuals scramble to get in early.

However, despite the allure of presales, they come with their own set of risks. The cryptocurrency market is notorious for its volatility, and the success of a presale is not guaranteed. Many projects fail to deliver on their promises, leaving investors with worthless tokens. In addition, the lack of regulation in this space can lead to scams or poorly conceived ventures, trapping unwary investors in projects that do not reach fruition. This precarious balance between opportunity and risk is what constitutes the “presale trap,” where the initial excitement can give way to disappointment and loss.

As the crypto landscape continues to evolve, it is essential for investors to approach presales with caution and a clear understanding of the associated risks. Understanding how to navigate this space effectively is crucial for minimizing potential losses and optimizing investment strategies. Recognizing the signs of reliable projects requires diligence and expertise, which is where the use of bots, scanners, and savvy market insights become invaluable tools in avoiding the pitfalls of presale investments.

The Reality of Presales

The realm of presales, despite the allure of rapid returns, often presents a more challenging reality for investors. Many enter the presale stage of cryptocurrency projects with optimism, lured by promises of high returns. However, numerous cases have emerged that illustrate the pitfalls involved. Projects like 99 Bitcoins, for instance, have encountered significant issues, whereby investors found themselves holding tokens that lacked utility or a clear roadmap. Such occurrences raise concerns about the integrity of certain projects.

Kaicat is another example of a project that fell short of investor expectations. Initially billed as a promising venture, it quickly turned into a cautionary tale. Once the tokens were distributed, investors experienced a stark decline in value due to poor project execution and lack of transparency, leaving them with dwindling assets. This scenario is representative of the broader presale landscape, where developers may prioritize capital influx over project viability.

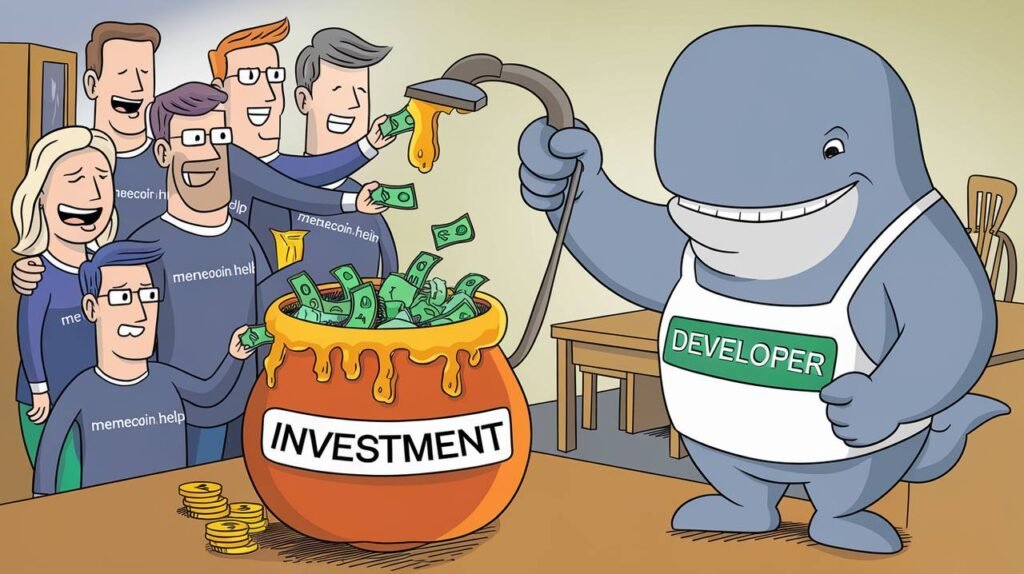

Furthermore, MeMusic and Propy demonstrate how presales can serve as exit liquidity for developers rather than an investment opportunity for backers. In cases like these, developers cash out early, making significant profits while investors are left holding depreciating assets. The notion that presales automatically lead to wealth is often misguided, as the reality involves inherent risks and the potential for significant losses.

As the presale ecosystem continues to evolve, it is vital for prospective investors to approach with caution. Understanding the landscape and recognizing red flags in project development are necessary skills for navigating these waters successfully. This sober perspective on presales underscores the importance of vigilance and informed decision-making in an increasingly complex market.

Common Pitfalls of Presale Investments

Presale investments can be an alluring opportunity, promising substantial returns in a relatively short time frame. However, several common pitfalls frequently trap unsuspecting investors. One of the most significant challenges in presale investing is the lack of thorough research. Many investors overlook the importance of investigating the project’s background, development team, and overall market viability. It is crucial to consider not just the potential of the project but also the credibility of those behind it. Failing to collect ample information can lead to misguided investments and financial losses.

Emotional decision-making also plays a detrimental role in presale investments. The fear of missing out (FOMO) can lead investors to rush into decisions without critical evaluation. Individuals may become overly enthusiastic about a project based solely on its anticipated hype rather than substantiated data. This emotional impulse often results in purchasing into projects that may not yield the promised returns, underscoring the need for measured and rational decision-making processes.

Misleading marketing tactics are yet another concern. Some projects utilize aggressive promotional strategies designed to entice investors without transparently conveying risks. Vague or exaggerated claims can make a presale offer appear more attractive than it is, so investors should always approach marketing presentations with a healthy dose of skepticism. Reviewing white papers and developer roadmaps carefully can aid in understanding the project’s true value.

Lastly, the absence of regulatory oversight leaves many presales vulnerable to fraud and untrustworthy practices. Unlike traditional investments, which often have community standards and regulations that govern them, presales may operate in a largely unregulated environment. This lack of oversight increases the risk of scams and opportunistic behaviors that can diminish investors’ capital. Therefore, investors should exercise caution and conduct thorough due diligence when navigating the presale landscape.

Why You Need Bots and Scanners

In the ever-evolving landscape of presale investments, the incorporation of modern technology has transformed how investors navigate potential pitfalls. Bots and scanners are essential tools that empower individuals to make data-driven decisions and minimize risks. Bots, which automate various processes, can perform tasks such as monitoring project developments, scanning announcements, and even executing trades at lightning speed. This level of automation is particularly advantageous in a fast-paced environment where timely action can determine investment success.

Scanners complement the functionality of bots by providing real-time data and analytics on presale projects. These tools sift through vast amounts of information, evaluating metrics such as social media sentiment, developer activity, and market trends. By harnessing this data, investors can identify potential red flags that may indicate a project is not a viable option. For instance, scanner algorithms can detect unusual trading volumes or other irregularities that may suggest a lack of legitimacy or transparency in a presale project.

The real benefit of utilizing bots and scanners lies in their ability to exhaustively research an extensive array of presale opportunities, ultimately providing investors with a comprehensive overview of the market. By employing these tools, investors gain access to a sophisticated defense mechanism that can highlight risks and foster informed decision-making. Moreover, automation permits investors to allocate their time and focus on strategic planning rather than spending excessive hours on manual research.

In conclusion, integrating bots and scanners into presale investment strategies is not merely an option—it is a necessity. These tools are invaluable in navigating the complexities of presales, empowering investors with the knowledge and agility required to stay ahead in a challenging environment. By leveraging these technologies, investors can confidently engage in presale opportunities while mitigating the inherent risks involved.

Real Talk: The Importance of Community Insights

In the evolving landscape of cryptocurrency presales, the significance of community insights cannot be overstated. Engaging with various online forums, social media groups, and specialized crypto communities offers invaluable perspectives that often extend beyond the information disseminated in official project announcements. These platforms serve as rich resources for potential investors, allowing them to gauge the sentiment and credibility of upcoming projects through the experiences shared by others.

By actively participating in discussions on these platforms, investors can uncover critical details regarding the project’s development, marketing strategies, and overall reputation. Community members often share personal anecdotes and firsthand experiences, which can illuminate potential red flags or highlight significant advantages that may not be immediately apparent. Additionally, these insights can offer a more diverse range of opinions, as individuals from various backgrounds and expertise levels contribute to the conversation.

Listening to previous investors’ experiences is especially crucial when assessing a presale’s viability. Investors who have previously participated in similar offerings can provide firsthand accounts of their outcomes, revealing patterns that could inform future decisions. Their feedback on issues such as transparency, the project’s team integrity, and the tokenomics can be instrumental in understanding the risks associated with investing in a particular presale.

Furthermore, community insights often encompass a collective analysis of market trends, competitor behaviors, and potential regulatory impacts. When investors align themselves with knowledgeable community members, they gain access to a wealth of information that can significantly enhance their understanding of the presale landscape. Therefore, engaging with these communities should be considered a fundamental step in the due diligence process for anyone looking to navigate the complexities of cryptocurrency presales effectively.

How to Avoid Getting Stuck in a Bad Presale

Investing in presales can be a profitable venture; however, it carries inherent risks that can lead to unfavorable outcomes. To mitigate these risks and avoid becoming stuck in a bad presale, investors must take a proactive approach. The foundation of a successful investment lies in thorough research, which is critical to understanding the project and its potential for success.

Firstly, conducting extensive research is paramount. Investors should delve into the project’s whitepaper, examining its goals, technology, and potential market. Important metrics to assess include the project’s roadmap, token distribution, and use case. A clear and well-defined project strategy signals a commitment to delivering value, thereby minimizing the risk associated with presale investments.

Furthermore, assessing the project’s fundamentals is essential. Investors should evaluate the problem the project aims to solve and its relevance in today’s market. Understanding the competitive landscape is also vital; this includes identifying competitors and analyzing their strengths and weaknesses. A project that demonstrates a unique solution or innovative technology is more likely to succeed.

Validating team credentials is another critical step. Investors should research the backgrounds of the project’s founders and team members, looking for their previous successes and experience in the industry. A strong team with a proven track record can greatly enhance investor confidence in the project’s potential.

Lastly, diversifying investments can serve as a buffer against losses. By spreading investments across multiple presales, investors can decrease the impact of a single bad investment. This strategy not only allows for potential gains across multiple projects but also reduces overall risk exposure. By following these comprehensive strategies, investors can significantly enhance their presale investment decisions and avoid getting stuck in an unsuccessful venture.

What to Do If You’re Already Holding Bags

Finding oneself in the unfortunate position of holding tokens from a failed presale can be disheartening. However, there are several strategies that investors can consider to navigate this challenging situation and potentially regain some value. Understanding the dynamics of the cryptocurrency market is essential, as it helps in making informed decisions about whether to sell or hold these tokens.

First and foremost, it is crucial to evaluate the reasons behind the presale’s failure. Analyzing the project’s fundamentals, team, and market sentiment can provide insight into whether the project has potential for recovery or if it is better to cut losses. If the project still demonstrates viability, holding onto the tokens with a long-term perspective could be an option. Investing in successful tokens often requires patience, and sometimes projects needing more time can eventually turn around.

If selling is preferred, consider approaching the market with a strategy. It may be wise to sell in smaller increments rather than liquidating all holdings at once. This tactic can help mitigate losses and allow for better positioning in the market. Utilizing platforms and tools to monitor price movements is also advisable, as these can provide insights into ideal selling points.

Moreover, engaging with the community around the token can provide valuable information and support. Other investors experiencing similar challenges may offer perspectives and strategies that have worked for them. Additionally, it is essential to remain informed about updates or announcements from the project team, as developments can significantly affect the token’s value.

Ultimately, while holding bags from a failed presale can be frustrating, it is vital to remain proactive. By employing sound strategies, staying informed, and cultivating a long-term perspective, investors can navigate these turbulent waters with hope and actionable plans.

Learning from the Past: Key Takeaways

Experiences in the presale landscape serve as valuable lessons, providing insights that can shape future investment decisions. One of the primary takeaways is the necessity of caution. Many investors have reported encountering issues such as failed transactions or scams, revealing the inherent risks associated with presales. It is crucial for participants to thoroughly research projects before investing, assessing the credibility of the offerings and the teams behind them. With numerous new platforms emerging, maintaining vigilance can prevent financial losses and emotional distress.

Additionally, leveraging technology in the form of bots and scanners emerges as another significant lesson. These tools can enhance the efficiency of the investment process, allowing users to act quickly during limited-time presale events. Bots automate tasks such as purchasing and monitoring token prices, ensuring that investors do not miss valuable opportunities due to human error or delays. Scanners assist in evaluating projects, filtering through vast information to identify high-potential ventures. Adopting these technological advancements can provide an edge, especially in a fast-paced environment where timing is critical.

Staying informed about industry trends and developments forms another essential component of navigating the presale arena. Knowledge about the market’s fluctuations, regulatory changes, and emerging technologies can significantly impact decision-making. Engaging with communities, attending webinars, and following reputable information channels can deepen one’s understanding and prepare investors for future challenges. Ultimately, those who view past experiences as learning opportunities will likely foster resilience and adaptability in their investment journeys.

In conclusion, reflecting on these key takeaways emphasizes the importance of caution, the utilization of tools, and continuous education in the ever-evolving presale landscape. Such an approach creates a foundation for making informed decisions that can lead to success in future endeavors.

Conclusion: Empowering Yourself as an Investor

In the ever-evolving landscape of cryptocurrency, presales often present themselves as alluring opportunities for investors seeking quick gains. However, it is essential to approach these ventures with a discerning mindset and an array of effective tools to mitigate risks. Bots, scanners, and critical strategies form the backbone of intelligent investment decisions, allowing individuals to navigate through potential pitfalls in presales.

Equipping oneself with the right technology and knowledge transforms the narrative around presales. Bots can automate the buying process, enabling investors to act swiftly in a fast-paced environment. Scanners, on the other hand, help analyze and assess the viability of different projects, providing essential data to inform choices. These resources are crucial for identifying promising presale opportunities while avoiding scams that often plague the cryptocurrency space.

Moreover, staying informed and participating in community discussions can empower investors to make well-rounded decisions. Engaging with expert opinions, market trends, and other investors’ experiences can illuminate various aspects of presale investments that may not be immediately apparent. Responsible investing practices are paramount; thus, setting clear goals and sticking to a well-planned strategy should be at the forefront of every investor’s approach.

Ultimately, as the cryptocurrency market continues to expand, the responsibility lies in the hands of individual investors to ensure they are making informed decisions. By leveraging the right tools and fostering an attitude of critical evaluation, one can navigate the presale landscape with greater assurance and success. The journey in cryptocurrency investing is enriching, and with the appropriate safeguards, investors can empower themselves to thrive in this dynamic environment.